B2B Software investments

Supporting industries through digitisation and automation

Our B2B Software investment team

Who we’re backing

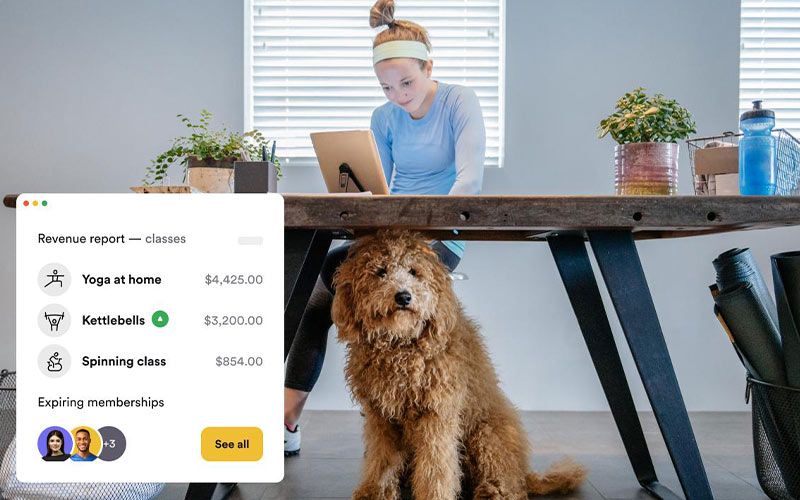

Advances in B2B software have an impact on every industry, bringing everyone closer to more efficient and sustainable ways of working. We’re looking for founders who are passionate and knowledgeable about the problems they want to solve. We back B2B software pioneers who are using their knowledge to transform and reshape the most traditional industries. We’re focused on evolving B2B commerce, empowering companies to sell more efficiently and make transactions easier.

Why us?

When you’re backed by Octopus, you get more than just a founder-investor relationship. We come with a network of skilled collaborators who can get behind your idea and help power the future of your business. B2B software is a huge market and our team covers the lot. Our long-standing portfolio companies, Permutive, Natterbox, Calastone and Ometria, have all benefited from our team’s diverse, collective experience. We have an office in the US and extensive resources to help founders who are based or expanding there.

The investment process

These are the general steps we follow – note that the process is slightly different at the pre-seed stage of investment.

Step 1

Send us your deck – if we think we’re a fit for your business, we’ll set up a call

Step 2

Meet some of our investors at a discovery meeting

Step 3

We’ll visit you at your office and spend some time with your team

Step 4

Present to our wider team at a partnership meeting

Step 5

We’ll tell you our final decision – if we’re not investing, we’ll say why

Our B2B Software portfolio founders